Trading doesn’t have to be overly complicated and we don’t need to predict the future. We can look outside all the news, noise and see what price is doing. In this video, I simply notice where buyers keep picking up Carnival Crusie Line (CCL) every time it comes down during a crisis.

Trade Craft

All Things Concerning the Language of Price

Foundations of Trading Part 6: Risk Management

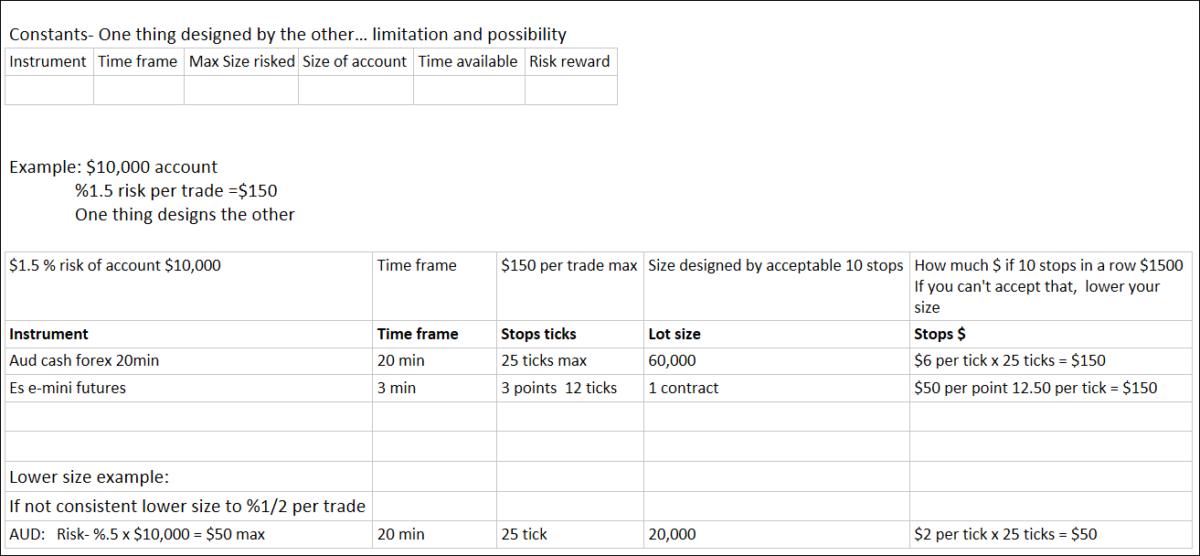

In Foundations of Trading Part 1, I stated the number one rule was the preservation of capital. We have no control over what markets do but we can take control of our money management and risk. In this video, I lay out some basic guidelines for working out maximum stop size with ATR (average true range) and designing our risk management plans. The image below shows an older example of a maximum stop size for AUD and ES. In the video, I show how to get the current maximum stops. You can use my simple guidelines for ideas in creating your own risk management plan and then ingrain it to the point where it’s not a discipline but a normal part of trading life.

Learning To Be Wrong

Effective trading is not about trying to be right on each trade, it’s about being fluid in an everchanging market. When we approach each trade trying not to be wrong, there is a layer of fear that clouds how we see things and effects our every decision.

This video is a Clip From one of our Live Sessions where I talk about consciously practicing with being wrong while demonstrating on a live USD/JPY market. I give a practice exercise to loosen up this aversion. As traders, we are going to be wrong a lot so its best to dispell the shame of it so we can approach each trade with more clarity.

The Beauty Of Median Lines

Let us understand the principles of what Median Lines are and what they do, then we can own them and use them to trade in our own ways. Our goal in learning about Andrews Median Lines is to understand what Allan Andrews understood, not to mimic him or anybody else.

In the Mapping Any Market any time Frame series, I show how to map markets with swings. In this video, I show how Median Line sets describe and project these swings and how to read the market one swing at a time.

Following Live: Theory Into Practice, February 2020

Change is the nature of markets, so the most important ability to develop as traders is how to change with change, to practice fluidity and not get stuck so much. The EUR/USD we followed last month was a lesson in practicing being able to flow with change by following relative swings from up to down. The E-Mini S&P taught us how price can push balanced minor swings up. This month we will map and follow Soybean futures and the USD/JPY.

A Study of How Price Moves

It’s not enough to just know how to recognize a market structure or memorize a bunch of technical analysis. That’s a start, but then we want to use those things to learn about how price moves and get that feel into our bones. In this video, I look at last week’s USD/JPY and E-Mini S&P mapping these markets using major/minor swings and the frame of the 3 types of trade options to learn about how price moves.

Waiting Outside of the Crowd

I have shown that there are 3 basic types of trade options related to market structures or lines. This month in our Language of Markets Live Sessions we put our focus on type 2 trades (Expand then continue). This kind of trade is like sitting outside of the crowd observing all the pushing and shoving and urgency, then calmly seeing where it all lands when the crowd gets confused. All of this is expressed in swings, in this post I use a Gold futures tick chart and a weekly NTES to study some of what makes a swing up, to see how the crowd’s urgency and subsequent confusion is expressed in price action.

Following Live: Theory Into Practice, January 2020

This month we’re going to map and follow the E-mini S&P and EUR/USD with swings. Last month, we mapped Gold Futures and USD/CAD which I review in the video. In the review, we learned a few things that we can begin to take into our experience and future trades. We learned that the Gold landed right into the pocket of our major projected swing with an intense drop. By mapping and seeing the market in swings, the intensity was pulled out and the wave was easy to see. In USD/CAD we learned how the minor swings can pick up speed and the possibility of using gaps for minor entries along the way.

To Push The NQ or Not: The Three Types of Trades

The three basic types of trades framework help you understand what you doing when you take a trade. It also gives you a way to frame the supply/demand dynamics of momentum, expanding or reversing markets. As a principle, we can use this framework with swings, gaps, lines or any other relevant marker sloped or horizontal. In this video of the recent NQ, we see a typical pattern of minor swings pushing and then letting all those people go “Taking Out The Cheap Seats” as it expands into a type 2 major swing. Once understood, you can even specialize in the type that resonates with you learning all its nuances or train in all three.