Trading is simple, but difficult due to the uncertain, uncontrollable, ever-changing nature of markets. It’s normal to have emotional reactions to having to make many decisions in an everchanging environment where our money and self-worth are on the line. We can talk endlessly about the phycological side of trading and of dealing with trader’s bad habits, but all it does is make you think there is something wrong with you. Instead, there is something we can do that handles many of these so-called bad habits in one swoop. We can structure a trading plan where we control the things that we can control and make many of these decisions ahead of time so that we are not doing it on the fly while under pressure. I walk through some of this in the video.

Know your method and design precise rules for and know ahead of time:

- Entry: Know what gets you in

- Initial stop: know where your stop goes

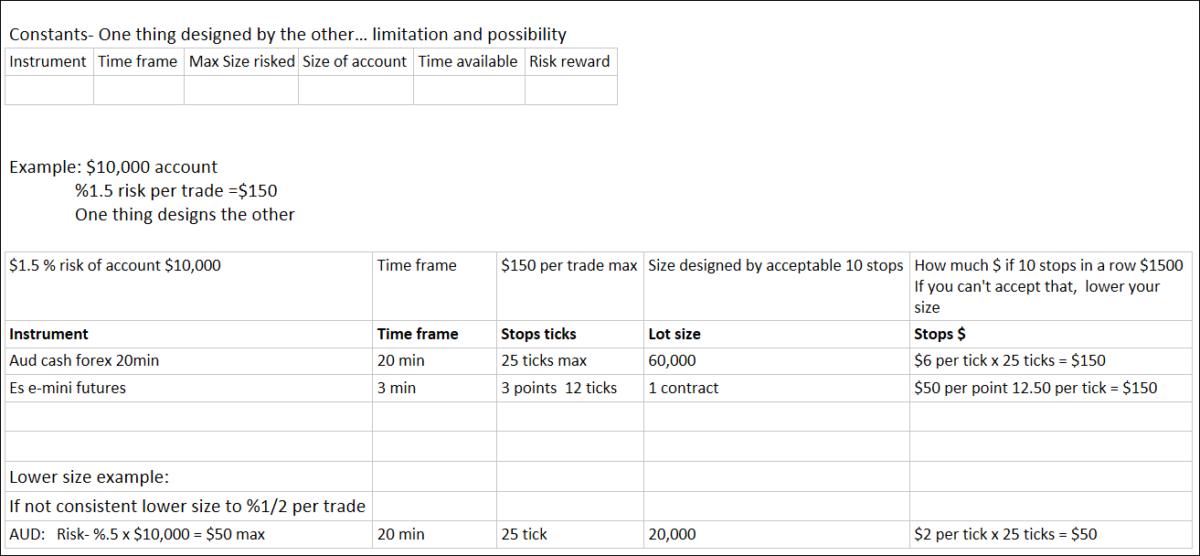

- Money management: Know your position size and trade management after in trade

- Exit: know what gets you out

Now you have limited your decisions down. You can choose to follow the plan or not. If over a period of trades you find that the plan sucks, re-work parts of it and do it all over again for another period of trades. After you have developed the discipline of following your plans, you can have flexibility within your structure.

There is a balance we must find between being too loose and being too rigid. Too loose, and we are all over the place and can’t get any consistent results to evaluate. Too ridged, and we risk not being able to adapt to markets. No plan you can design will be perfect, they all will have possibility and limitation, but I have found in my own trading that having a mediocre plan is better than having no plan. Mostly, we need to match up to our particular method with the money management plan that works well with that method and then follow the plan. You may have some resistance to all of this structure, but take it one step at a time as your ready.