Month: March 2020

Simply Noticing: Carnival Cruise Line

Trading doesn’t have to be overly complicated and we don’t need to predict the future. We can look outside all the news, noise and see what price is doing. In this video, I simply notice where buyers keep picking up Carnival Crusie Line (CCL) every time it comes down during a crisis.

Foundations of Trading Part 6: Risk Management

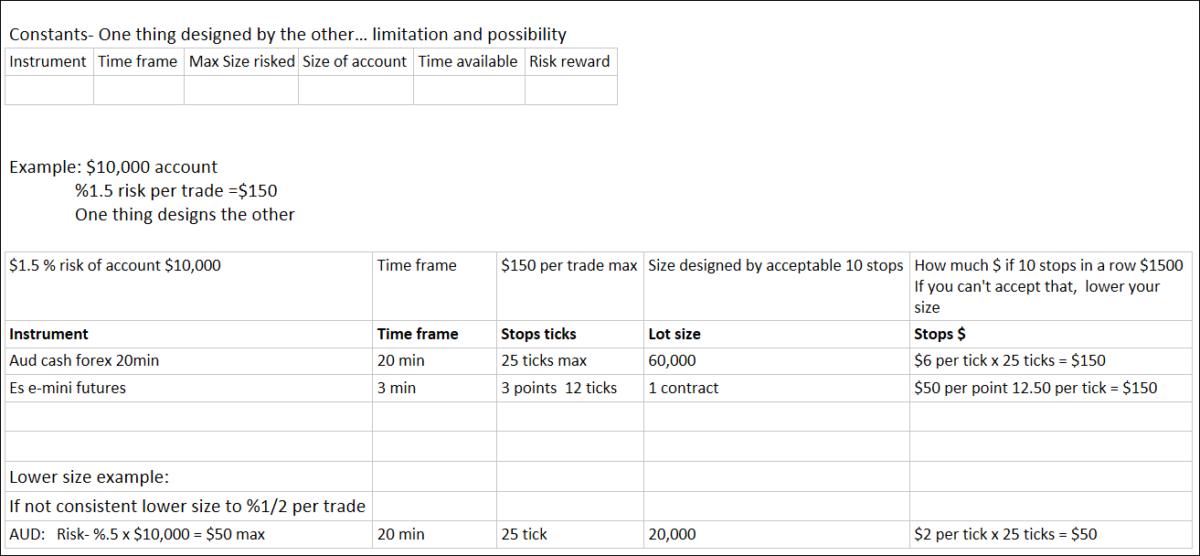

In Foundations of Trading Part 1, I stated the number one rule was the preservation of capital. We have no control over what markets do but we can take control of our money management and risk. In this video, I lay out some basic guidelines for working out maximum stop size with ATR (average true range) and designing our risk management plans. The image below shows an older example of a maximum stop size for AUD and ES. In the video, I show how to get the current maximum stops. You can use my simple guidelines for ideas in creating your own risk management plan and then ingrain it to the point where it’s not a discipline but a normal part of trading life.

Learning To Be Wrong

Effective trading is not about trying to be right on each trade, it’s about being fluid in an everchanging market. When we approach each trade trying not to be wrong, there is a layer of fear that clouds how we see things and effects our every decision.

This video is a Clip From one of our Live Sessions where I talk about consciously practicing with being wrong while demonstrating on a live USD/JPY market. I give a practice exercise to loosen up this aversion. As traders, we are going to be wrong a lot so its best to dispell the shame of it so we can approach each trade with more clarity.

The Beauty Of Median Lines

Let us understand the principles of what Median Lines are and what they do, then we can own them and use them to trade in our own ways. Our goal in learning about Andrews Median Lines is to understand what Allan Andrews understood, not to mimic him or anybody else.

In the Mapping Any Market any time Frame series, I show how to map markets with swings. In this video, I show how Median Line sets describe and project these swings and how to read the market one swing at a time.