Risk Management

Adjusting Stops for Volatility

When volatility changes so must our stops and we need to keep in touch with this. Here I review how to calculate stops using a simple Average True Range method (ATR) that I mentioned in Foundations of Trading Part 6 Risk Management. I also go over the current 20-minute currencies to show how to keep in touch with this volatility.

Foundations of Trading Part 6: Risk Management

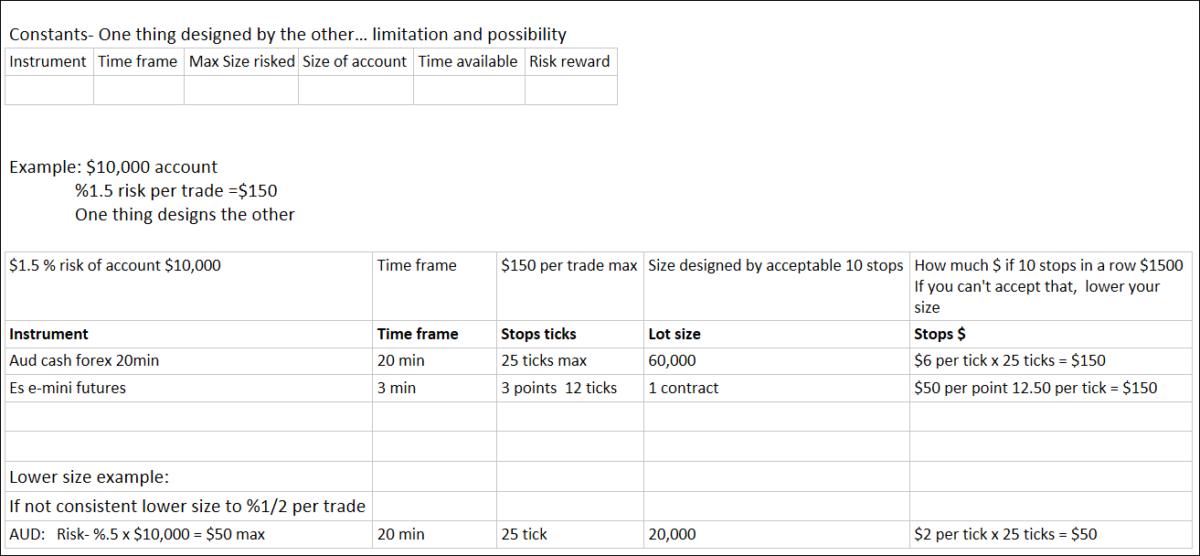

In Foundations of Trading Part 1, I stated the number one rule was the preservation of capital. We have no control over what markets do but we can take control of our money management and risk. In this video, I lay out some basic guidelines for working out maximum stop size with ATR (average true range) and designing our risk management plans. The image below shows an older example of a maximum stop size for AUD and ES. In the video, I show how to get the current maximum stops. You can use my simple guidelines for ideas in creating your own risk management plan and then ingrain it to the point where it’s not a discipline but a normal part of trading life.

Foundations of Trading Part 4: Trade Planning

We make a trade plan, execute, then evaluate to see what we can learn about price and ourselves. Making and documenting a trade plan helps us to clarify what it is were doing and thinking at the time of a trade, it makes us more accountable. A trade plan can also serve the purpose of holding us steady after we are in the trade and subject to more emotional reaction.

A trade plan is a personal thing that needs to be adapted to you and your trading. Its best to keep it simple. My trade plan just asks a few simple questions and then I take a snapshot of the chart.

- Why am I entering?

- Why am I placing my stop there?

- Why am I moving my stop?

- Why am I exiting?

Its a simple question that asks why are you doing what you are doing? Don’t just be technical about this, also answer the questions as honestly as you can. If you entered a market cause you were impulsive or because the moon was blue or whatever.. write that down. If you are placing your stop real close cause you are scared of risk, write that down. If you jump out early cause you cant take take it anymore write that down. Don’t be embarrassed you have plenty of company including me now and then but you can be one of the few who actually takes an honest look and learns. Here is a recent trade plan of mine that did not get filled.

Shane Blankenship

Foundations of Trading Part 1: Preserving Your Capital

This is the first in a series of foundational lessons on the principles of trading. These foundational lessons are relevant to any instrument, time frame or methods that you use.

- Preservation of Capital

- Market Structure

- Andrews Median Line Tools

- Trade planning

- Self-Management

We start with money management. Because if you blow through your money you won’t last long as a trader. Money management starts with self-discipline, which is the first thing every trader should begin to foster. Preservation of capital is paramount. If you’re not currently profitable, cut your trading size down; you have to earn the right to size. Always use hard stops, which means, put in a stop order at the same time that you place your entry order. Know your maximum risk per trade, and stick to it. My risk management is 1.6% of my account per trade.

We will talk about Market Structure in the next part of this series.