TRADE CRAFT

Trading is an art. As in any artform, skill comes through application and practice. This is how we approach the craft of trading at Language of Markets. Here, in Trade Craft, you'll find a collection of posts that demonstrate our approach.

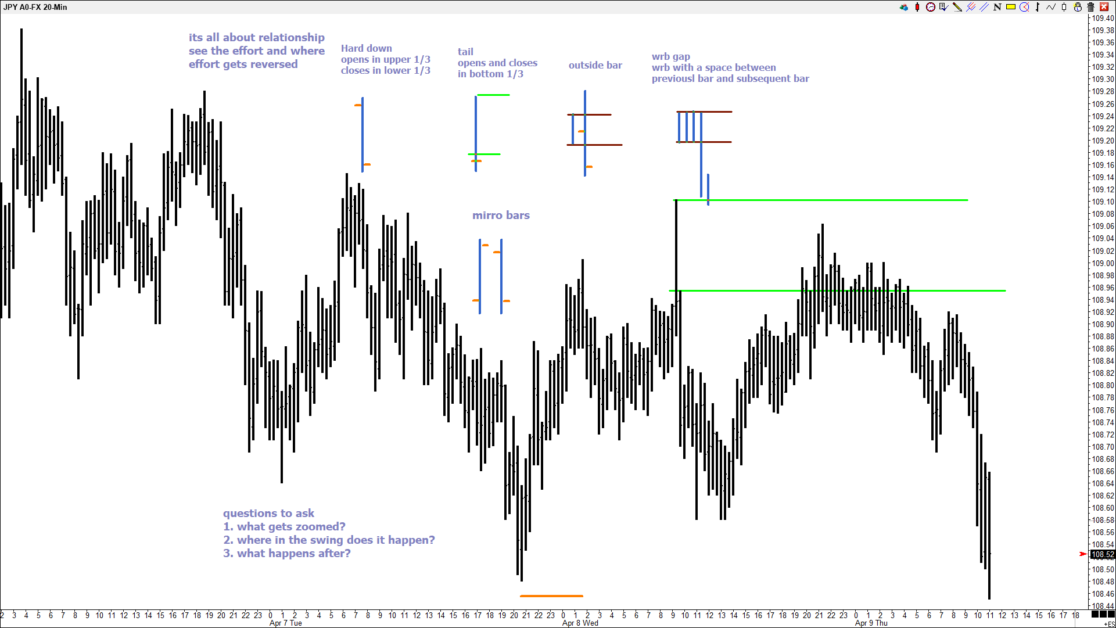

Following Live: Theory Into Practice. April 2020

Last month we followed the Nasdaq E-Mini futures and NZD/USD into historic volatility and crazy. We mapped and followed them calmly with simple swings the same way we always do,...

Mapping The S&P E-Mini Weekly

We all see things differently and mostly experience markets through past personal experiences which distorts what is going on. We especially get our buttons pushed during times of high volatility...

Adjusting Stops for Volatility

When volatility changes so must our stops and we need to keep in touch with this. Here I review how to calculate stops using a simple Average True Range method...

Simply Noticing: Carnival Cruise Line

Trading doesn't have to be overly complicated and we don't need to predict the future. We can look outside all the news, noise and see what price is doing. In...

Foundations of Trading Part 6: Risk Management

In Foundations of Trading Part 1, I stated the number one rule was the preservation of capital. We have no control over what markets do but we can take control...